We look at the different types of buyers for companies and how they are different.

Types: Private Equity & Strategic

There are three types of buyers seeking to purchase your company for sale. They are:

1) Strategic Buyers: Strategic buyers (companies) are viewed as the premier type of buyer for a seller’s company. The reason is that one assumes a strategic buyer has a synergistic need to make the acquisition and so will be hard pressed to not close a transaction once started. Secondly a strategic buyer typically will pay more for a company than a PE firm because a PE firm has no synergies with the company being acquired and has valuation limits placed on it by the banks that will be lending a portion of the money to the PE firm to complete the transaction.

2) PE (Private Equity) Groups: PE groups typically look at a variety of companies for sale but typically have a preferred group of industries that they prefer to look at, typically a function of the industry experience of the PE partners and/or board members and/or related. Aside from industry preferences, a PE group will look to invest in a company if the business model appears that it will continue to be successful in the future (may have material barriers to entry, patented products, quality management team, etc.) and the Company can be grown with the addition of capital and/or assistance from the PE group (use relationships to add customers, grow into new geographic regions, etc.). PE firms typically need a management team to remain with the selling company for an extended period of time post the deal closing to continue

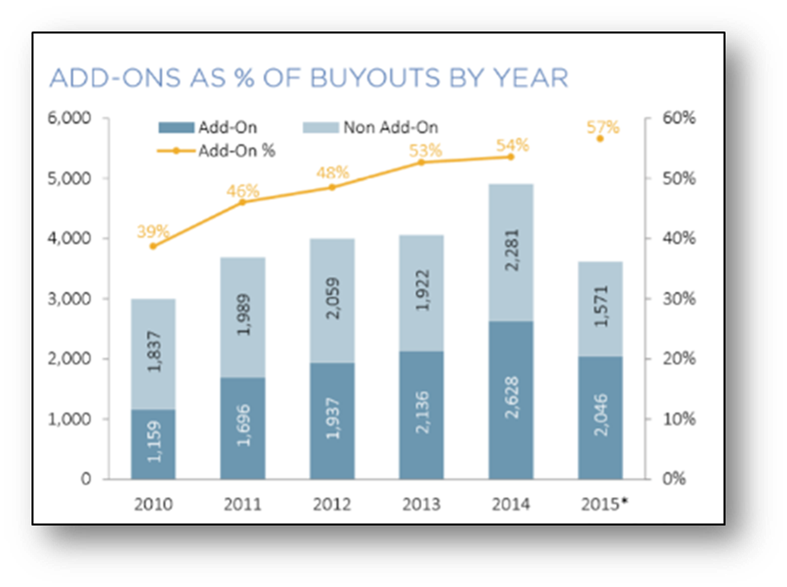

to manage the company because a PE firm does not have capable company management. This is in contrast to a strategic buyer which can often move managing personnel into the seller’s business if needed. As you can see from the graph above, PE firms own many of the companies that we see every day. PE firms currently own 5.799 US companies.

3) PE Firms With Portfolio Company Holdings: A good buyer for a company is a PE group that owns a company that has synergies with the selling company. For example a PE group that owns a tire distributor in the northeast may be interested in a tire distributor in the southeast to expand market share, or a manufacturer of tires for cars may see synergies in owning a manufacturer of tires for trailers and other equipment because the manufacturing processes are similar. Often a PE group with a portfolio company that has synergies with your selling company is a better buyer than simply a PE firm with no related company as the latter has no synergies to motivate a purchase. As indicated in the graphic above, 54% of all buyouts last year were add on acquisitions for PE portfolio companies.