significant interest, with approximately six buyers bidding for the company. Ultimately,

the company was acquired by Claire Capital, marking a successful and competitive sale.

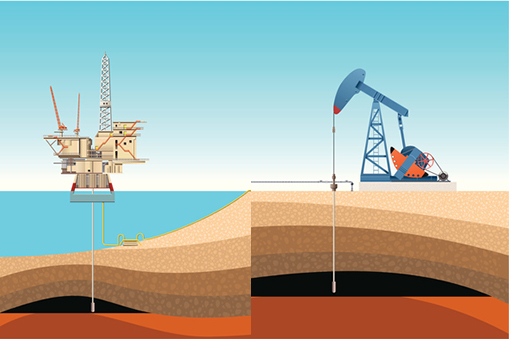

We Specialize In Selling Oilfield, Energy, & Industrial Service Companies

The lines separating oil & gas service companies and industrial & energy service companies is thin and our 15 years has enabled us to develop an expertise in industrial & energy service companies. From electricity to industrial waste and cleaning and product manufacturing such as valves and pumps we have valued and completed hundreds of industrial and energy transactions. Let our experts maximize the value of your company sale.

remanufacturing of in-plant industrial valves and related components. In February 2023,

the company was sold for an extremely large multiple of EBIRDA, surpassing all valuation

goals set by its owners.

a portfolio company of Towerarch Capital. The sale price exceeded the owner's expectations,

who was extremely excited to partner with Chemtec. Reports indicate that both the buyer

and seller are very pleased with the integration and success of the combined companies.