No one can compete with the accuracy of our oilfield service business valuation reports because no one else has the volume of comparable private oilfield service company sales transactions that we do. NO ONE.

Overview of Ferguson White’s Proprietary Private Oilfield Service Company Transaction Database

Every business valuation includes the application of a number of industry accepted valuation methodologies included the discounted cash flow model, public company comparable analysis, asset liquidation analysis and private company comparable analysis. The most effective valuation methodology is the private company comparable transaction analysis. The problem is that it is all but impossible to find private company transaction data and when on the rare occasion it is found in a paid for database, no information exists about the details of the deal and relevant structure to provide confidence in the use of the data. As oilfield industry specialists, we have a large volume of historical oilfield service company transactions thereby providing us with a competitive advantage over any other firm valuing oilfield service companies. With this proprietary information, we are able to provide clients with business valuations more accurate than any other.

Company Transactions

Ferguson White’s graphical representation of its propriety database of historical oilfield transactions completed.

For client company valuation based on application of private oilfield service company historical transactions, we select the company’s most comparable to client’s business.

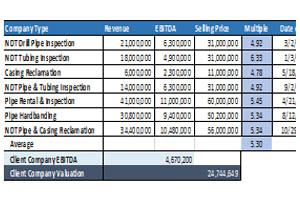

We populate Client Company Comparable Transaction Valuation report with most applicable comparable companies from historical transaction database to determine client company value..

Preparation Report

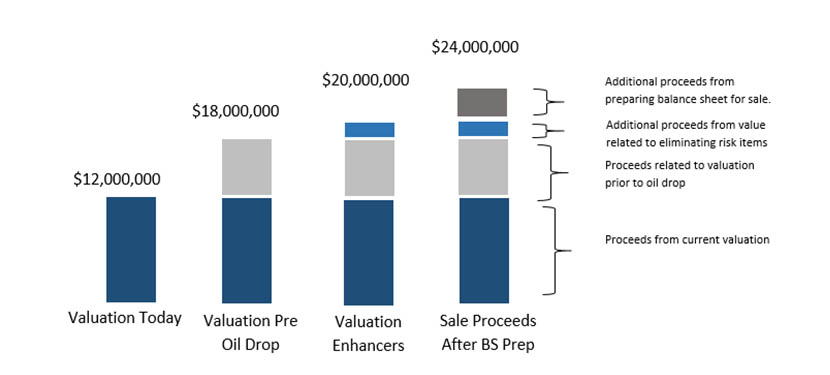

- Includes 4 company valuations: now, just prior to the most recent industry downturn, at some point agreed to in the future, and at some point in future to include recommendations in this report to increase value and cash proceeds from sale.

- Identification and quantification of specific ways to increase company value (typically $500k to $2 mm)

- Identification of changes that can be made to increase cash proceeds at deal closing (typically $300k to $1.5 mm)

- Ideal future timing to sell

- Sales process to execute to sell to guarantee maximum selling price

Oilfield Service Company Business Valuation

This comprehensive valuation report includes the application of all valuation industry accepted valuation methodologies including discounted cash flow, public company comparable, asset liquidation and private company comparable analysis. As previously outlined our volume of private oilfield service company transactions is large and proprietary and enables us to provide the most accurate valuation of your oilfield service company available. The report analyses and normalizes client company financials for accurate client company valuation and includes an industry section. Our specialization in oilfield service company mergers & acquisitions enables us to provide the most accurate and comprehensive valuation of your oilfield service company.

Oilfield Service Company Sale Preparation Report

Valuation Accuracy at Multiple Points in Time: Included in this report is the valuation of your oilfield service using our proprietary library of comparable private transactions. In this report we provide the valuation of your business now, prior to the most recent oilfield industry downturn, and at an agreed to date in the future which enables the business owner to manage the company’s growth towards the future.

Identification of Valuation Detractors & Ways to Eliminate Detractors & Increase Valuation:

As oilfield service company M&A specialists that have been through the marketing, negotiations, and due diligence for hundreds of oilfield service companies, and in conjunction with our proprietary library of closed oilfield service company transaction data, Letters of Intent, data on failed transactions, and daily conversations with buyers, our Seller Preparation report identifies specific areas where your oilfield service company is losing value. We quantify these areas of deficiency and advise on how to correct them. In many cases our clients are able, and have the time, to make recommended changes and eliminate the company characteristics causing loss of value identified in our report. Examples include customer concentration, too much owner dependence, old equipment, vendor concentration and the like. As an example, in the case of owner dependence, we may have identified the owner doing too many day to day specific company tasks. This increases the perceived risk of the acquisition for the buyer who may fear loss of continuity at the company should the owner be unable to perform his/her tasks post transaction. We would advise our client to decentralize his daily tasks by assigning functions to other employees thereby removing the appearance that the owner is too heavily involved in the day to day business activities.

Increase Your Cash at Transaction Closing:

At every closing we see our sellers leave hundreds of thousands and often millions of dollars with the buyer that they could have retained for themselves with better planning. Sellers are required to leave with the company “normal” assets and liabilities, including working capital, customary for a typical transaction. With planning and enough time prior to closing (1 year is optimal), sellers can manage the assets and liabilities they are required to leave behind with their sold company and should easily be able to net $500,000 to $2,000,000 in cash in hand that they would have otherwise left behind.

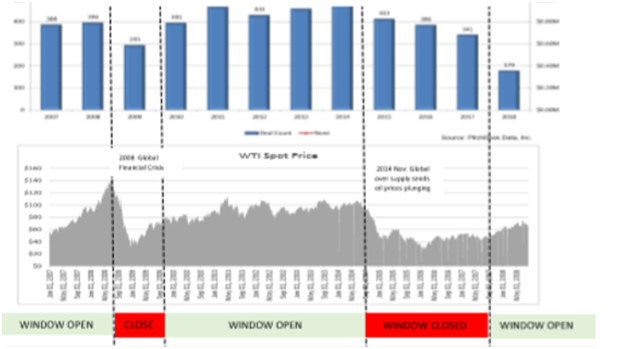

Best Time to Sell:

The oil industry fluctuates as we all know depending on the price of oil. We have been through the business cycles and can advise our clients when the best time is to sell their oilfield service business. We support our reporting with historical oilfield service company sales volume and pricing.

Guarantee Highest Price Paid for Your Company:

Our Preparation for Selling report uses oilfield service company transaction data and buyer Letters of Intent to compare the prices offered and ultimately paid for our oilfield service companies when the auction process is utilized. The auction process is essential to ensuring our client’s leave no money on the table and the highest price is paid. We show how historical auctions were executed and summarize increasing offers during the process. Clients can see, based on our reporting of real auctions for oilfield service companies, how the auction process maximized the price paid for the oilfield service company. Clients understand that they will be guaranteed to highest price paid for their oilfield service company by employing an auction process for the sale of their oilfield service company.