We have read a lot about companies having special banquets or meetings where buyers are on hand, or the idea of international buyers being the best type of buyer for a client’s company. We want to cut through some of this “noise” and explain where buyers come from so that sellers can choose their advisors appropriately.

Buyers come in two basic forms: 1) Private Equity Groups or 2) Strategic buyers (another company). We exclude individuals or angel or venture capital groups from this discussion because these buyer types apply to only the smallest of companies (EBITDA less than $1 mm) or companies that are very extreme in some way and don’t represent the audience we are addressing here which is the 99.9 % of companies for sale that are meat and potatoes companies generating over $1 mm in EBITDA.

Strategic buyers, or companies, purchase other companies that are in some way strategic to them. Typically there are any number of synergies between the buyer and seller making the acquisition beneficial to the acquiring company. For example a food manufacturer likely would look at acquiring a specialty food company to add to its product mix. The way an advisor finds this buyer is to research in their buyer database all the companies that manufacture food that could benefit from adding this new product. The advisor brings as many of these similar food companies/buyers to the table as possible in order to maximize the number of eyeballs on the seller’s company and maximize the number of potential offers. The point here is that buyers know what they are seeking and it does not matter if the advisor has a special relationship with the buyer or hosts a special meeting or banquet with the buyer attending or anything related to this. Any of these special relationships between an advisor and a buyer is likely not in the best interest of the client as it does not promote maximum exposure nor maximum number of offers required to maximize value for the seller. The only way to have the best interests of the seller in mind is to objectively bring the maximum number of buyers to the table for the seller at the same time. Not to post the company for sale on a web site or have a special relationship with a buyer or host a special meeting or banquet with certain buyers present. Again none of these special relatinonships maximizes value for the seller nor brings the maximum number of relevant buyers to the table. Only the objective method of searching buyer databases for all of the companies that are in the same or similar industry as the seller and bringing these buyers to the table is in the best interest of the seller.

PE firms evolve with respect to the types of companies they are interested in but typically have a range of industries they like based on the experience of the partners and/or look for specific characteristics in companies. Regardless, the only method to ensure an advisor maximizes the number of PE groups looking at a seller’s company is to use a PE database and research all the PE groups with portfolio companies in the same or similar industries as the seller and get these PE groups looking at the seller. No special relationships with PE groups or related is in the interest of the seller. Make certain your advisor has the resources to invest in the buyer databases necessary to make certain all potential buyers are brought to the table at the same time.

At Ferguson White we search our buyer databases for both strategic and PE acquirers that either are in the same or similar industry or own subsidiaries or portfolio companies in the same or similar industries as our client. These are the primary potential acquirers for our client’s company and we make certain we bring all of their eyeballs to our client companies.

Examples of Ferguson White Buyer Data Used When Identifying Buyers for Client Companie

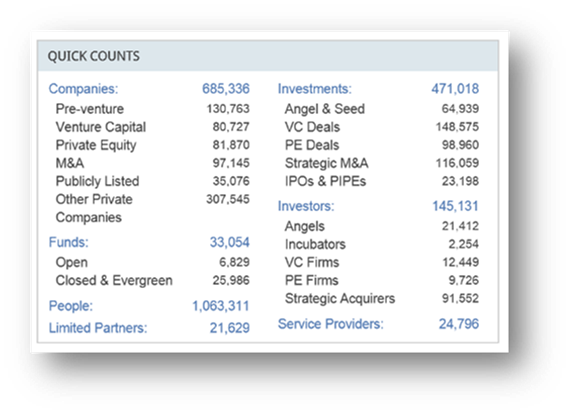

At Ferguson White our buyer database is a significant investment but we know it is the only way to ensure we maximize the value of our client company’s sale. Of course we supplement the objective research that uncovers the majority of buyers with buyers we have worked with on prior similar deals as well as buyers that contact us. But at the end of the day you need to make certain as a seller that your advisor has he resources to invest in the buyer databases to bring all the buyers to the table at the same time to create your confidential auction process. Below is a snap shot of the buyers tracked at Ferguson White via our databases.

At Ferguson White our buyer database is a significant investment but we know it is the only way to ensure we maximize the value of our client company’s sale. Of course we supplement the objective research that uncovers the majority of buyers with buyers we have worked with on prior similar deals as well as buyers that contact us. But at the end of the day you need to make certain as a seller that your advisor has he resources to invest in the buyer databases to bring all the buyers to the table at the same time to create your confidential auction process. Below is a snap shot of the buyers tracked at Ferguson White via our databases.

Finally, we have worked with international buyers on a variety of deals. We have noticed that some advisors promote their relationships with international buyers, or their ability to contact international buyers as a valuable resource for you as a seller. We can tell you first hand that for an international buyer to make the investment necessary to acquire a North America based company, the company being purchased has to be of significant size typically to make the investment worth the effort. By size we mean typically the company would be over $50 mm in value at the lowest. Our point is international buyers are very very rare at the size of company we are talking about. Yes we live in a global economy and technology has compressed international borders but a company still has to be of fairly significant size for any international buyer to have interest. Of course we can contact international buyers but at the end of the day you will likely end up with 0 or 1 international buyer and 99% domestic buyers for your company. Include international buyers but there is nothing special about them for your company because they simply are not the best buyer for the size of your company typically.

So at the end of the day the buyers typically come from the buyer databases that require significant annual investment to make certain your buyer information is current. Don’t fall for any other promotion or the tease of international buyers. The buyers for 99% of US companies are right here in North America and our databases and prior deal acquirers and interested groups should make up 99% of the buyers looking at your company.

Don’t leave money on the table. Make certain your advisor has access to the buyer data and will proactively bring all the buyers to your deal to generate multiple offers and the confidential auction to maximize your company value.